Millions of dollars are lost each year to fraudulent checks, which happens more than you might think. The 2019 Check Fraud and Telemarketing Fraud Report shows that $1.4 billion in fraudulent statements were written in 2018. While check fraud can be scary, there are steps you can take to protect yourself. This blog post will look at ways to spot-check hustle and report it. Keep reading to learn more!

What Is Check Fraud?

Check fraud is when a checking account is illegally or fraudulently accessed or changed. Check fraud is typically performed by making a copy of the check and then writing the document to the payee.

Another type of check fraud is when a forged check is created. A forged check is made when someone uses a copy of a statement and alters it. The fake check is then taken to a bank, cashed, and then returned to the bank, where the account from which the money was taken is closed. This is an example of check fraud, but you should be aware of other types of check fraud.

How To Protect Yourself From Check fraud?

Electronic banking is convenient for consumers and banks alike. However, criminals are taking advantage of this convenience. If your bank sends you a check, only cash it if it looks like it comes from a legitimate source.

Fraudulent Checks

- Can come in the mail or as an online request.

- May look like they are from the bank, but they aren’t.

To protect yourself from check fraud with MRB Software, don’t cash any check or transfer money from an account unless you recognize the name on the statement.

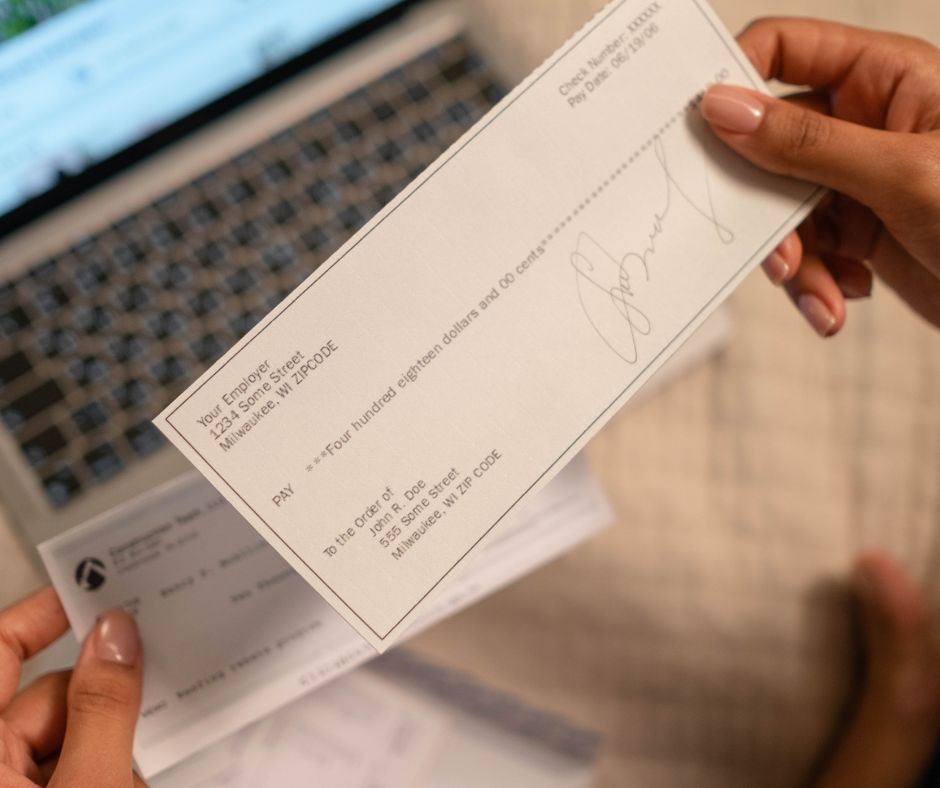

Here are some things that can help you determine whether a check is fraudulent:

- Does the check look legitimate? Most checks don’t have a watermark, but legitimate checks do. Checks are made on special paper, so look for visible quality differences. Make sure the amount, date, and payee’s name match.

- Does the check have a routing number? Routing numbers often begin with nine digits. A legitimate check will have a routing number.

- Does the check have a check number? Check numbers, or serial numbers, help banks track checks. If the bank sends you a check, there should be a number on the check.

- Does the check have a check amount? A legitimate check has a check amount.

- Does the check have a signature? A legitimate check has a signature, usually from two authorized signatures.

How To Report And Recover From Check Fraud

If you’ve been the victim of check fraud, there are a few things that you need to do to report the crime and recover your losses.

The first thing that you need to do is contact your bank or financial institution. They will need to file a report with the appropriate authorities and need your account information.

Next, you will need to gather all the documentation you can. This includes canceled checks, bank statements, and any other relevant documents. You should also keep a copy of your paperwork if you need to produce it in court.

If you have lost money due to check fraud, there is still hope for recovery. Contact a lawyer to discuss your legal rights and options. They can help you navigate the legal system and get the most favorable outcome for your case.

How To Avoid Check Fraud?

Check fraud is becoming more common these days, and thieves are becoming more sophisticated in their methods. Here are a few ways that you can avoid being a victim:

- Double check photo ID

Thieves can steal your information using a simple photograph. Make sure that the person on the check matches the person in the picture ID. Fraudsters can copy your signature, which means that your signature may be different from the one on the check.

- Verify the person’s address

Check the address on the check. Make sure that the address matches up with the person’s shipping address. Call the bank immediately if the address on the check does not match up with the person’s shipping address or if the address does not match up with the billing address.

- Compare the date that the check was written to the date that the bill was paid

Ensure the check was dated within the past 90 days; otherwise, it may be fraudulent.

- Beware of checks that have a blank backside

A blank back side means that the check was not written. You will not be able to cash the check.

- Do not let someone else sign your check

If anyone is with you when you are at the bank, make sure that they do not sign the check. If someone signs the check, and you think you are not responsible, your bank may imply that you are trustworthy by signing the check.

Leave a Reply